How Billionaires Dodge Taxes.

Many Corporations Already Don't Pay A Federal Income Tax, Many Billionaires Don't Either.

In wake of the Trump Administration’s $4.5 trillion in tax cuts for the wealthy, it brings the need to highlight how unnecessary this is.

Billionaires already have plenty of ways to avoid paying taxes.

Take for instance Tesla, which paid zero federal income taxes in both 2022 and 2024 despite making $5.5 and $2.3 billion respectively. In 2023 Tesla only payed $48 million on $3.1 billion in profits, a rate of 1.5%.

Far below the corporate tax rate of 21%. Important to note, undocumented immigrants paid an average of $8,889 in federal income taxes in 2022. Meaning they averaged a higher tax burden than a billion dollar corporation.

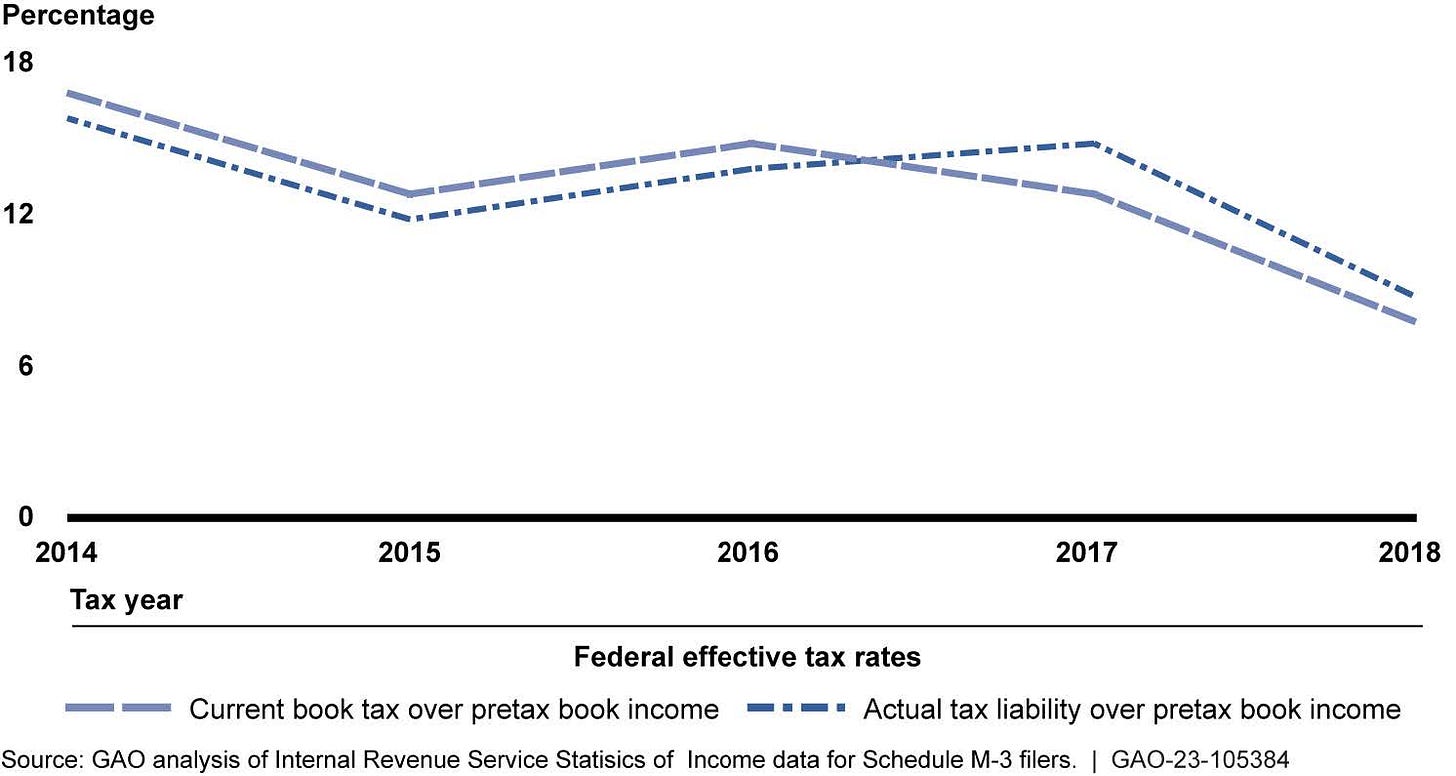

In fact, just in 2018 under Trump’s first administration, 34% of large corporations that were profitable paid nothing in federal income taxes. The average tax rate paid by these large corporations was just 9%, far below the 21% that was shown on paper.

Also far below the average paid by most Americans.

It gets even worse.

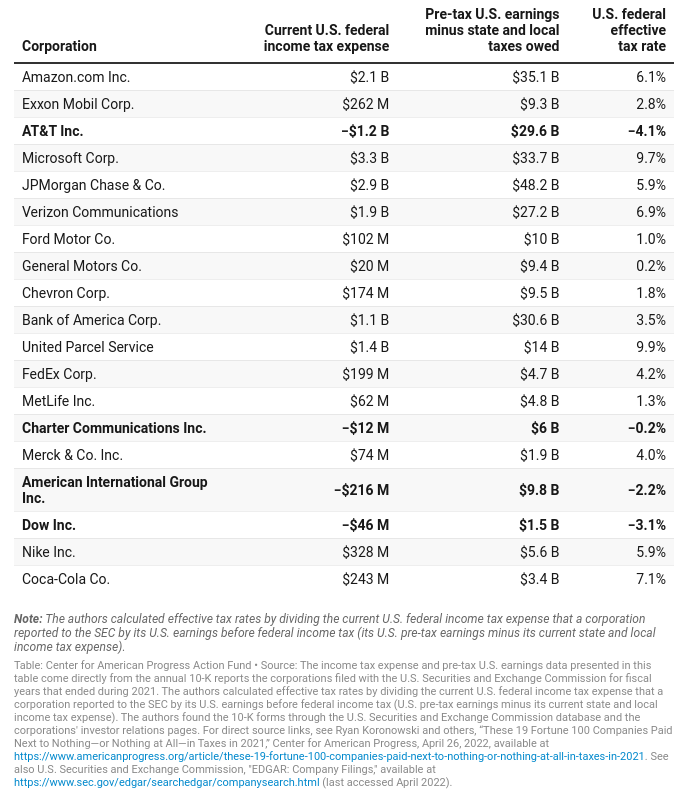

A report from the Center for American Progress found that while AT&T made $29.6 billion in 2021, they paid nothing in federal income taxes that year. Instead, AT&T got a $1.2 billion refund from the IRS.

Similarly, Charter Communications Inc received $12 million in a refund on $6 billion made. Companies like Dow Inc and American International group also were refunded millions while reporting billions in profits.

Here is a quick list of billion dollar corporations who paid less than 10% in taxes in 2021, keep in mind, most Americans pay between 12%-22% in federal taxes.

Amazon’s effective federal income tax rate was 6.1 percent in 2021, with $35.1 billion in U.S. earnings and $2.1 billion in federal income taxes.

ExxonMobil’s effective federal income tax rate was 2.8 percent in 2021, with $9.3 billion in U.S. earnings and $236 million in federal income taxes.

Microsoft’s effective federal income tax rate was 9.7 percent in 2021, with $33.7 billion in U.S. earnings and $3.3 billion in federal income taxes.

JP Morgan Chase’s effective federal income tax rate was 5.9 percent in 2021, with $48.2 billion in U.S. earnings and $2.9 billion in federal income taxes.

Verizon’s effective federal income tax rate was 6.9 percent in 2021, with $27.2 billion in U.S. earnings and $1.9 billion in federal income taxes.

Ford’s effective federal income tax rate was 1 percent in 2021, with $10 billion in U.S. earnings and only $100 million in federal income taxes.

GM’s effective federal income tax rate was 0.2 percent in 2021, with $9.4 billion in U.S. earnings and only $20 million in federal income taxes.

Chevron paid only $174 million in federal income taxes, earning $9.5 billion last year. That’s an effective federal income tax rate of only 1.8 percent.

Bank of America’s effective federal income tax rate was 3.5 percent in 2021, with $31 billion in U.S. earnings and only $1.1 billion in federal income taxes.

UPS’ effective federal income tax rate was 9.9 percent in 2021, with $14 billion in U.S. earnings and $1.4 billion in federal income taxes.

FedEx’s effective federal income tax rate was 4.2 percent in 2021, with $4.7 billion in U.S. earnings and only $199 million in federal income taxes.

MetLife’s effective federal income tax rate was 1.3 percent in 2021, with $4.8 billion in U.S. earnings and only $62 billion in federal income taxes.

Merck’s effective federal income tax rate was 4 percent in 2021, with $1.9 billion in U.S. earnings and only $74 million in federal income taxes.

Nike’s effective federal income tax rate was 5.9 percent in 2021, with $5.6 billion in U.S. earnings and only $328 million in federal income taxes.

Coca-Cola’s effective federal income tax was 7.1 percent in 2021, with $3.4 billion in U.S. earnings and only $243 million in federal income taxes.

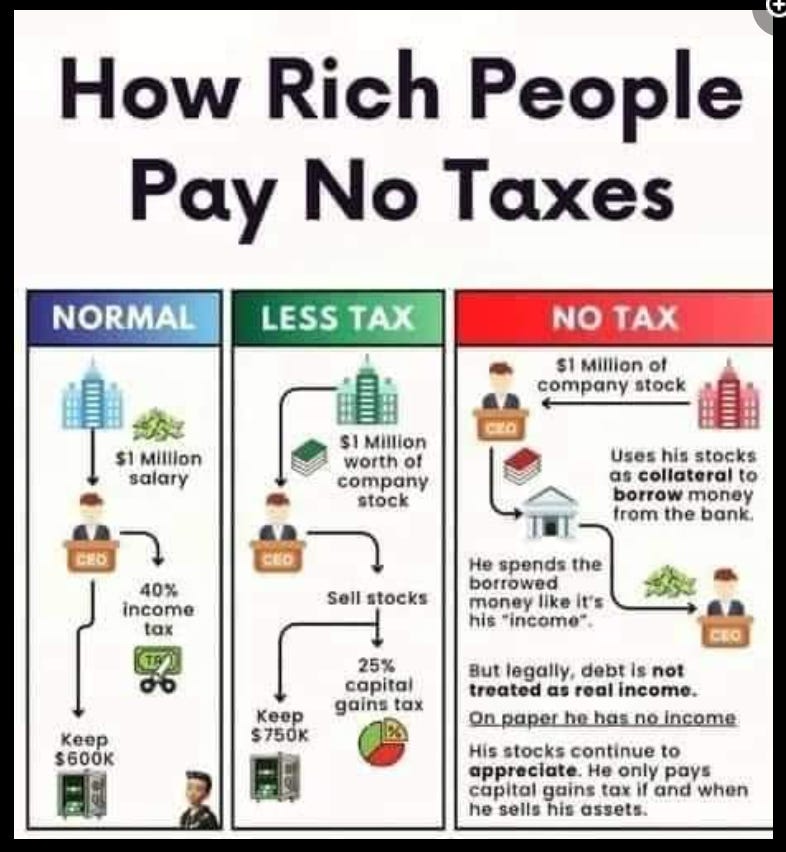

But corporations aren’t the only entities dodging taxes, the wealthy have means to do this on the individual level as well. Through simple schemes of hiding their income, as no income means no taxes.

There are multiple ways to do this, from “money warehousing” where you store it in tax havens, to being paid in stock that has a lower tax rate once sold than it would as income.

Or, placing it in assets you then leverage to borrow money to buy more assets. As borrowed money is considered debt, which isn’t taxed, and you won’t be taxed on the assets until you sell. Then hold them until you die, and pass them on to those inheriting them tax-free.

Take this example. You get a new job making $1,000,000 a year, after paying your 40% tax rate you now have $600,000.

Instead, you could ask to be paid in $1,000,000 worth of company stock. Then once you sell, you pay the 25% capital gains tax and now have $750,000.

Or a third, more enticing scenario, you get paid in $1,000,000 in company stock but you don’t sell it. You leverage it as collateral to get a loan from the bank, then spend the money from the loan instead.

He’s buys some art and real estate that will appreciate in value, but the rest on whatever. On paper, he has debt and no income. Which means he pays nothing in taxes on that $1,000,000 in income.

These are the schemes billionaires and their corporations indulge in every single day to assure they are avoiding as many taxes as they possibly can.

I have some questions about the numbers here. The effective tax rate is framed as taxes as a percentage of earnings. What are "earnings?"

If a company earns $100 million in "earnings" but spends all of it on salaries and investments into itself, it's still at zero profit, and I'd argue it shouldn't be taxed at all. Providing jobs and opportunities is a good thing, taxing this doesn't help anyone

Besides, much of the tax incidence is going to fall into employees anyway, so raising the corporate tax rate doesn't really help the common worker.

The best way is still a land value tax, hands down. Second best I have come up with is a broad and low VAT.