Social Security Is Worth Protecting.

Despite Conservative Outcries, Worker Productivity Will Keep Social Security Afloat.

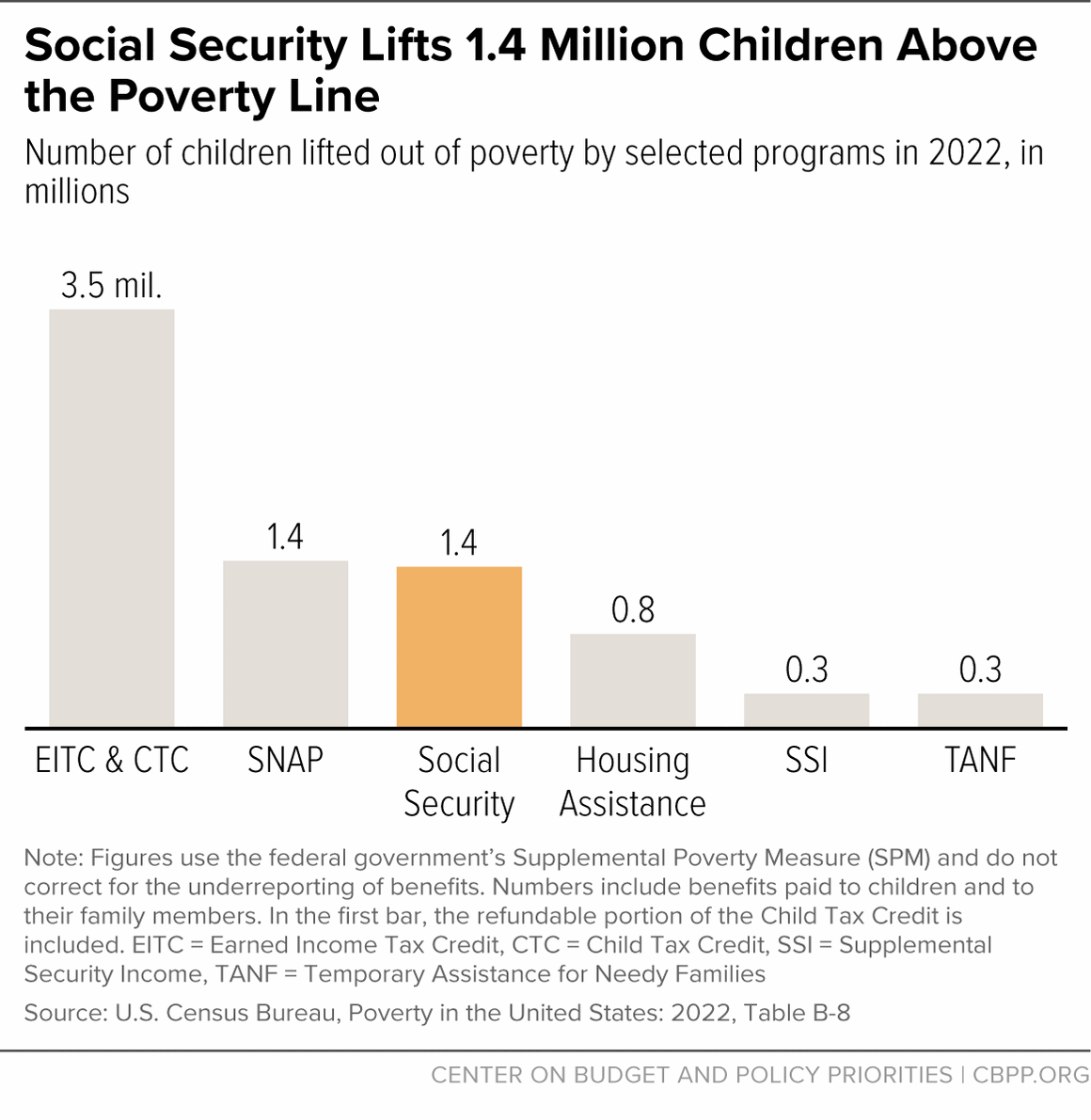

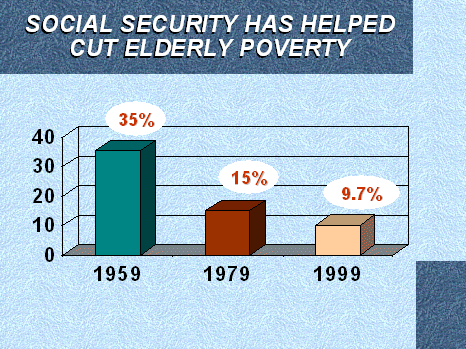

Social Security has a claim as the most crucial function of the government. It lifts more people out of poverty than any other government program. There is a total of 22 million people lifted above the poverty line by Social Security.

Surveys have shown as much as 67% of seniors rely on Social Security for at least half their income, 27% for their full income, and almost 70% of seniors would be in poverty without it.

Even almost 1 million children are raised out of poverty due to the program. Ethnic groups are more likely to rely on Social Security, as are women, due to the pay gaps that still exist to this day.

It also operates at an efficient level, with administrative costs being only 0.5%, or relatively nothing. Meaning the money going in the program is almost entirely going to the people meant to benefit from it.

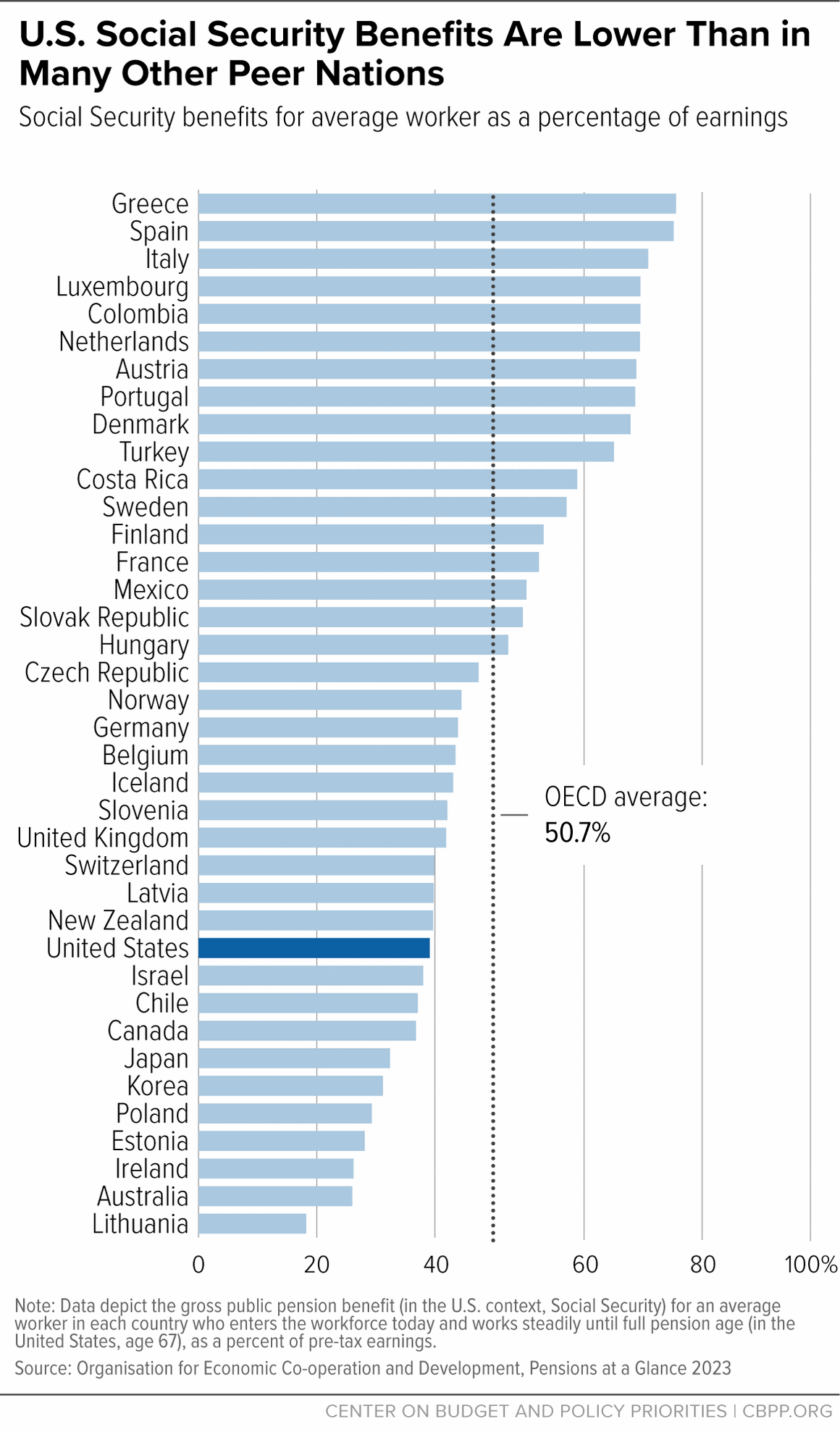

Also, this is not some lucrative program exclusive to the United States. We actually rank in the bottom 4 developed countries in how much we supplement income after retirement. The global average among developed countries is 50%, the United States only averages 40%.

There are some lesser known benefits to be provided with Social Security as well. Around 96 percent of people aged 20-49 who worked in jobs covered by Social Security in 2023 earned life insurance protection through the program. Also, 90 percent of people aged 21-64 who worked in similarly covered employment in 2023 were insured through Social Security in case of severe disability.

Social Security is a guaranteed foundation for retirement that also tracks with the cost of living, and is implemented on a progressive basis.

For many, it will be their only source of retirement income not at risk of financial market fluctuation or other natural investment risks. It’s also not a risk of being wiped out due to medical bills or personal emergency.

Low-income earners who are the least able to save for retirement will see around 40% of their income replaced by Social Security, while higher-earners more able to save will see closer to 30%.

In an economy where cost-of-living continues to rise but wages remain stagnant, especially as artificial intelligence begins replacing low-skilled labor, this kind of fail safe becomes more necessary than ever before.

After the Earned Income Tax Credit and Child Tax Credit, no system lifts more children out of poverty than Social Security. Over 5.7 million children live in homes that receive Social Security benefits. This includes over 2.6 million who receive benefits as dependents of retired, disabled, or deceased workers.

Critics of Social Security who claim it will run out either misunderstand or misrepresent the projections. It is true that with no changes the Social Security’s combined Old-Age and Survivors Insurance (OASI) and Disability Insurance trust funds would be exhausted in 2035, but they were never meant to be permanent.

Furthermore, even without these funds and nothing else changing to how Social Security revenue is collected, 83% of benefits would still be able to be paid out. Most of these estimates also forget to calculate in worker productivity.

As workers continue to produce more year after year, there is more money being created and taxed thus more money being put into programs like Social Security.

If we wanted to continue paying into these trust funds, or otherwise ensure 100% of benefits can be paid going forward the simple solution is to remove the cap on maximum taxable income for Social Security.

We currently stop taxing income for Social Security at $160,200. Removing this could allow for hundreds of billions of additional revenue each year.

If you want to tweak Social Security as you feel it is not as efficient as it could be, that is a perfectly fine stance. Any large scale program will always have room for improvement. But do not be fooled.

Those pushing to disband Social Security are only doing so for their own best interests, either angry at their payroll being taxed or their income, as they have investments or savings they can otherwise fall back on.

This isn’t the reality for most people. Nor should it have to be. I couldn’t even fathom telling someone they deserve poverty because they didn’t start their stock portfolio early enough.

Social Security exists for those who did everything right, saved their entire life, only to have it all wiped out paying for cancer treatments.

Or the woman who’s house burned down so she had to spend her savings starting her life over just 10 years before retiring.

Also, despite how conservatives may want to negatively stigmatize it, it’s also for those who’s expenses just didn’t allow them to save the way they should’ve.

The idea the government shouldn’t provide a baseline guarantee of some sort of income post retirement is one predicated on entirely entitled and privileged world views. It’s also one that no other developed country in the world holds.