Trump's Big Beautiful Bill Is Set To Make America A Very Ugly Place.

Aside From Raising Taxes On Americans Making Less Than $51,000 A Year, The Bill Cuts Major Spending From Crucial Programs Like Medicaid.

After weeks of Republican infighting, the Big Beautiful Bill Act has officially passed in the house by a 215-214 vote. By Republicans, this is being promoted as “the biggest tax cut in American history.”

This of course comes without some crucial context.

The bill itself is set to add $3.1 trillion to the federal debt over the next decade, over $5 trillion if temporary provisions are extended. Despite increasing debt by 7.2 percent in 10 years and 12.0 percent in 30 years, it only stands to increase GDP by 0.5 percent in 10 years and 1.7 percent in 30 years. The average wages fall slightly in 10 years but slightly increases by 0.8 percent in 30 years.

Hardly a bill that pays for itself, or spurns massive economic growth.

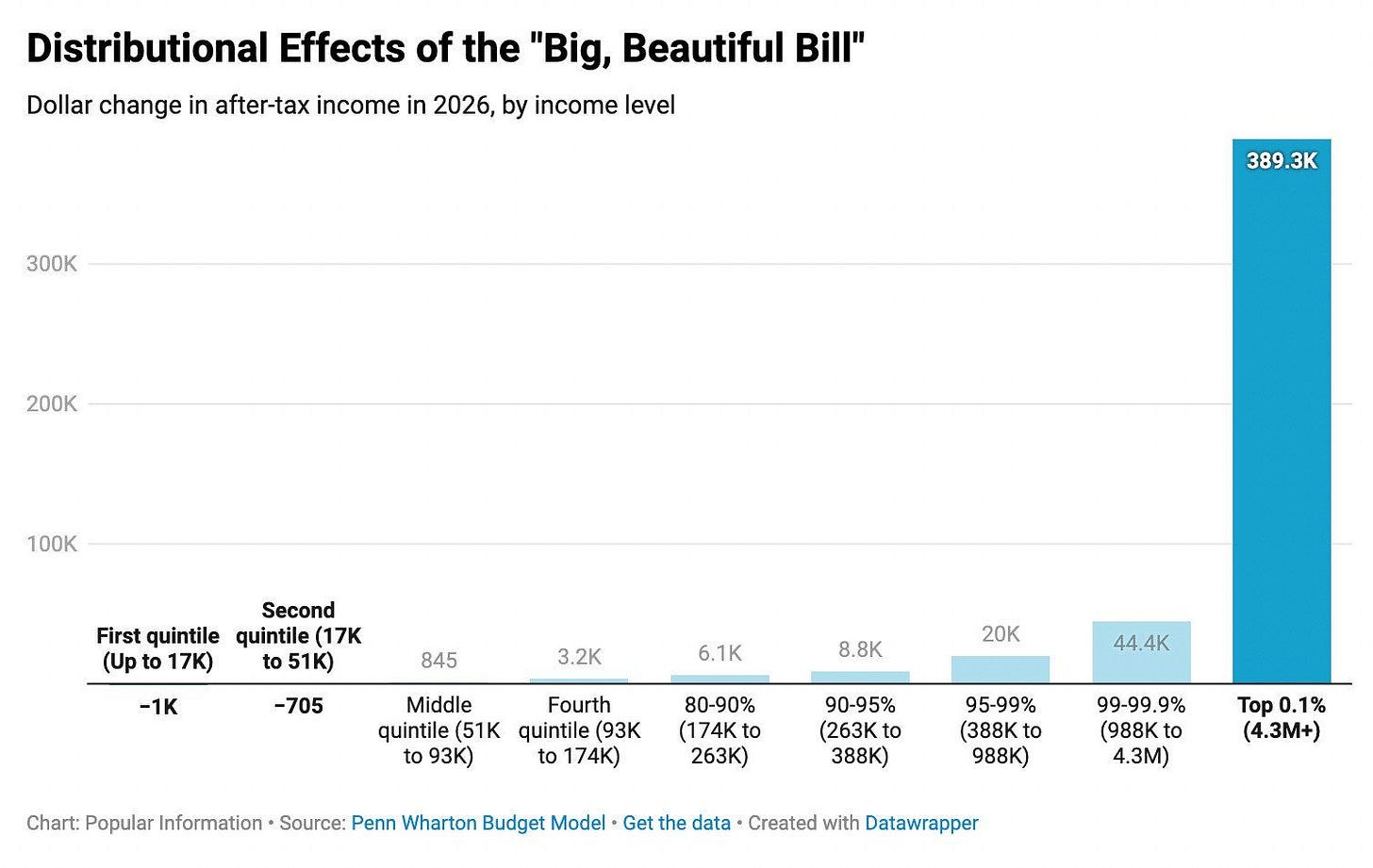

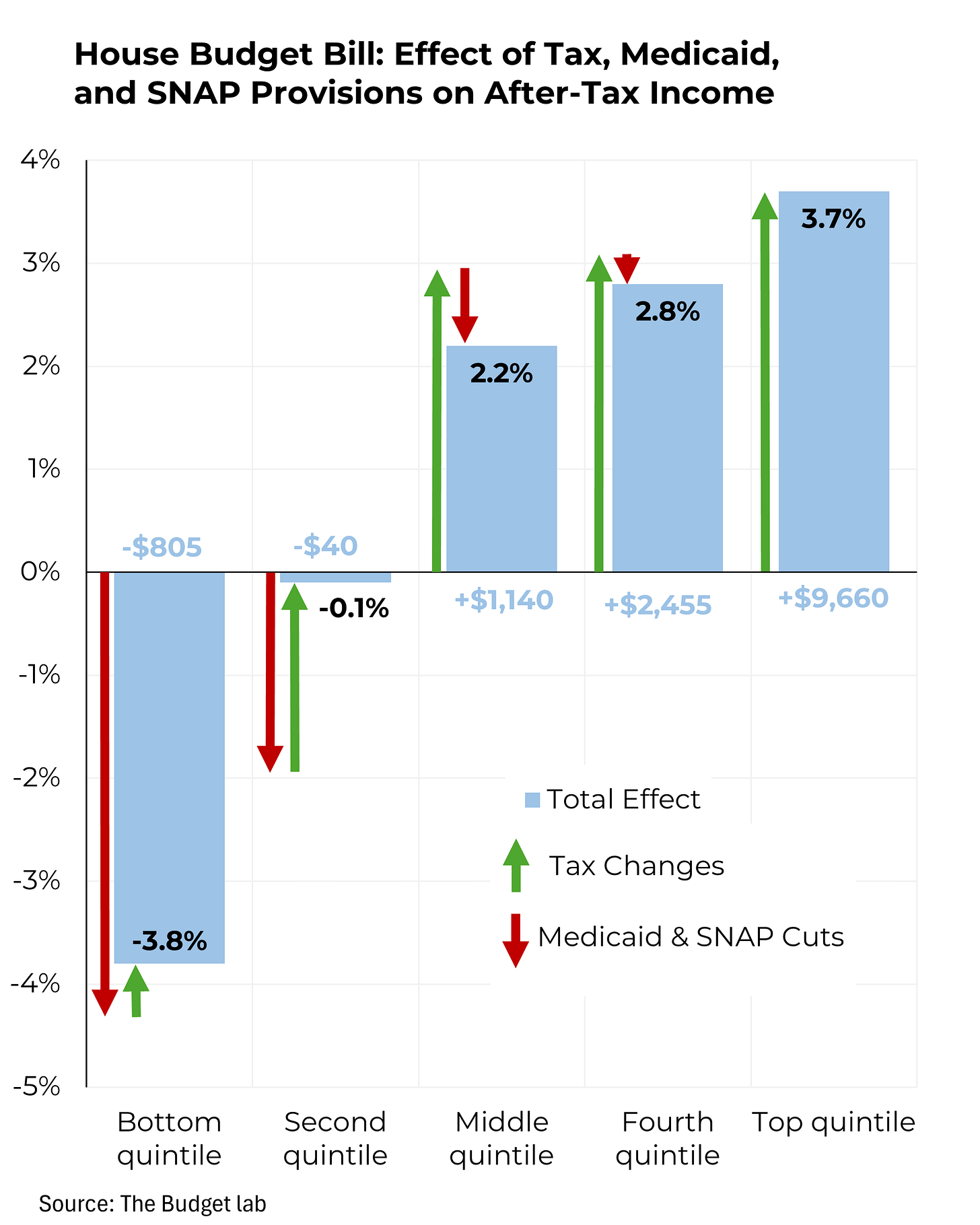

Furthermore, per multiple independent analysis, by 2029 Americans making less than $51,000 a year will actually see their taxes increase. With key provisions Trump ran on like “No Tax On Tips” or “No Tax On Overtime” being temporary provisions that will phase out by 2028.

Those at the top however will see massive returns, in large part due to the disproportionate provisions included in the bill that only apply to the extraordinarily wealthy.

Including a raise in the estate tax exemption to $15 million, meaning inherited properties will not be taxed until they exceed that value. With provisions like slashing the Alternative Minimum Tax (AMT), the lowering of the corporate tax rate, and deductions on pass-through income all renewed from the 2017 tax cuts.

It also includes aggressive provisions to curb spending, many of which also will drastically effect the middle class. This includes work requirements for Medicaid, and capping the limit it can provide in payment assistance for critical treatments or medicines.

The Congressional Budget Office (CBO) estimates between 7 million and 10 million Americans will lose their health coverage as a result of these actions.

When factored into how this bill effects Medicare, with multiple marketplace provisions and the debt increase triggering automatic Medicare cuts of $500 billion, the number of Americans who will lose healthcare as a result of this bill tops 13.7 million.

This bill would also take the ax to almost $300 in food assistance programs, including effecting eligibility for free lunch programs for some students. It also ends the Thrifty Food Plan, which is how households were calculated on how much benefits to receive in order to afford nutritional meals, rather than whatever is cheapest.

Currently over 41 million Americans rely on food stamps, with it reducing food insecurity by as much as 30%.

Finally, the bill would eliminate the Inflation Reduction Act’s clean energy tax credits, this put as many as 686,000 jobs (both operational and construction) at risk. As well as hinders crucial climate advances made under the Biden administration.

Companies have invested $321 billion in the manufacturing and deployment of clean energy, and carbon management, leading to over 2,000 new facilities that created over 300,000 jobs across the country. There is currently over $500 billion in investment, and the aforementioned 686,000 jobs now in limbo thanks to this bill.

Mixed with Trump’s tariff plan, his economic agenda is one that shifts the tax burden onto the poorest Americans, while funding tax cuts for the rich by slashing crucial programs relied on by the middle class.

Only to simultaneously be making everything more expensive, another action that weighs more heavily on those with the least amount of money.