Why Don't We Ever Discuss The Velocity Of Money?

A Simple, Often Underdiscussed Economic Principle Perfectly Shows The Harm In Top-Down Tax Cuts Like We See From Republican Presidents.

There are often many reasons given to oppose tax cuts for the top 1%. These are the exact cuts we see in the One Big Beautiful Bill, matched with the brutal spending cuts to healthcare. However, one of the stronger and easy-to-understand reasons are often overlooked.

That’s the rate at which money is exchanged in an economy, or the Velocity of Money.

Let’s first discuss what exactly this means, why it’s important in this context, and what it means for tax cuts that disproportionately benefit the wealthy.

Broadly speaking, velocity of money is the rate at which money exchanges hand between business and consumer, business and business, or otherwise. This can be figured by first multiplying the price level by the real GDP, and then dividing by the M2 money supply.

In simple terms, multiple the average of the cost of goods in your economy, by the value of those same goods and services in the economy and divide it by the total amount of money circulating.

Other factors that can affect this are consumer behavior, in times where consumer prefer saving to spending obviously then velocity would drop. Also when there are fewer barriers to transactions, like more credit lines available, the velocity tends to increase.

Why does this matter?

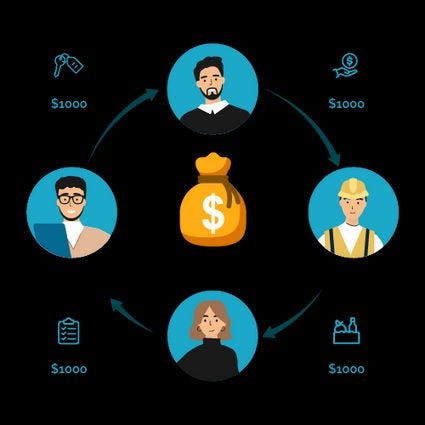

As cash circulates in the economy, it is able to fill the place of multiple dollars. Where as you could take $1 and hold it in stock investment, it would escape taxation and transaction further in the economy. If instead that dollar is spent at a local business, that business can use it to pay wages, and the employee in turn can spend that dollar again.

This creates successive rounds of expenditure allowing it to actively contribute to short-run aggregate demand in a much greater fashion.

Also, higher velocity increases the number of taxable events per dollar without expanding the monetary base. This allows governments to raise more revenue without increasing nominal tax rates or enlarging the money supply, both of which in turn can create inflationary pressures.

Why does to prove tax cuts for the wealthy ineffective? Because of another economic principle called Marginal Propensity to Consume, which effectively measures the velocity of cash by various income levels based on their propensity to spend their income.

Strong data indicates that those in the middle and lower class have a higher marginal propensity to consume, which makes sense. They spend larger portions of their income on everyday necessities, while the wealthy tend to instead save their income in larger amounts.

Thus tax bills in which shift a larger tax burden onto the middle class, lowering their income and making consumers less willing to spend, seems economically inefficient. Allowing instead the wealthy to keep larger portions of their income will only enable them to save more, which is fine in practice, but creates problems on a macroeconomic level.

One of which being the need for “artificial” stimulus of the money supply, which creates inflationary pressures.

By funneling more money into the hands of those more willing to spend it, and having tax incentives for the wealthy to invest their profits, we create a more robust economy that works for everyone.